Automatic enrolment – Workplace pension duties

Under the Pension Act 2008, every employer in the UK must put certain staff into a workplace pension scheme and contribute towards it. This is called “automatic enrolment”. If you employ at least one person you are an employer and you have certain legal duties.

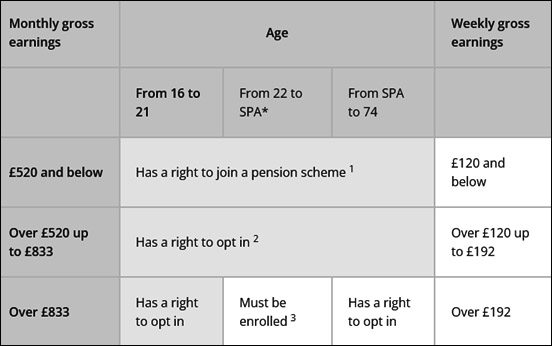

Depends on an employee’s salary that as an employer, you will have different choice regarding to pension. Details as following:

From the table, you can see the options as following:

If an employee’s wage is from £520 or below per month, they has the right to join a pension scheme but the employer doesn’t have to pay contributions into a pension scheme.

If an employee’s wage is from £520 up to £833 per month, he/she has the right to opt in, which means if they ask to be put in a pension scheme, the employer must put them into a pension scheme that can be used for automatic enrolment and pay regular contribution.

If an employee’s wage is over £833 per month, he/she has the right to opt in, employer must put these members of staff into a pension scheme that can be used for automatic enrolment and pay regular contributions. The employer doesn’t need to ask their permission. If a member of staff gives notice, or the employer gives them notice, to leave employment before the employer has completed this process, the employer has a choice whether to enrol them or not. The employer also has a choice whether to enrol a director who meets these age and earnings criteria.

When to enrol and pay contributions into a pension scheme

On the date your client’s duties begin they must carry out a full assessment of all their staff.

After their duties come into effect, your client’s staff (including those on variable pay, flexible pay, irregular hours, etc) should be enrolled the first time they earn over the automatic enrolment threshold of £192 a week or £833 per month if paid monthly.

Once staff have been enrolled, the employer must pay regular contributions into their pension scheme. If the staff member’s earnings fall below £120 per week or £520 per month, the employer may stop paying contributions unless the rules of the pension scheme they have enrolled into require them to continue. You should check with the pension scheme what their rules are.

Opting out, opting in and joining a scheme

It’s against the law to try and persuade staff to opt out of (or leave) a pension scheme.

If employer doesn’t have anyone to enrol, you still have other duties.

What if an employer doesn’t have any staff other than directors?

An employer won’t have any automatic enrolment duties if any of the following apply:

- They are the sole director

- The only people working for them are a number of directors, none of whom have an employment contract

- The only people working for them are a number of directors, only one of whom has an employment contract

Automatic enrolment will apply if more than one director has a contract of employment.

Full details on the circumstances in which directors are exempt from automatic enrolment can be found on director exemptions from automatic enrolment.

So as an employer, your duties include:

- Assess your workforce to determine the automatic enrolment duties for individual members of staff

- Enrol the staff into a pension scheme selected by employer.

- If an employee’s wage is over £833 per month or £10,000 per year, they must enrol the employee into a chosen pension scheme, inform the employee and they have the right to opt in or opt out within a certain period, and as an employer, you must act upon their request.

In simple explanation, any employee with income over £833 or £10,000 per annum, employer must enrol them into a pension scheme and act upon request of the employee to opt in and opt out.

Choosing a pension scheme: There are various pension provider on the market for you to choose from. The majority of them would charge for being their member and in the scheme. We usually advise client to choose NEST which is a pension scheme set up by the Government and it cost nothing to set up.

Once you have chosen the pension scheme and enrol your eligible staff:

- If he/she chooses to opt out of pension, then when the pension scheme send them an welcoming letter and their membership number by post to their home address, they must contact the pension scheme to opt out. We can help at this opt out stage if we have their membership number.

- If he/she chooses to opt-in to pension, employer must submit their pension contribution on monthly basis to the pension scheme and pay for that. Currently, the standard rate and minimum rate of contribution is 5% (of the salary) from employee and 3% (of the salary) from the employer. The government will top up 20% of the pension contribution. So for example, if an employee pay in £5 from their salary, employer pay into the employee’s pot £3, the government will top up £2. In total, an employee will get £10 in their pension pot.

We are here to support you in every step of this pension requirement.

For each of our client, we will contact and go through with you the pension duties applicable for your business.

Thank you for your reading.